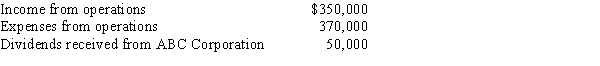

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Schedule M-1 of Form 1120 is used

Q69: Schedule M-1 of Form 1120 is used

Q76: Robin Corporation,a calendar year C corporation,had taxable

Q79: Which of the following statements is correct

Q91: Almond Corporation,a calendar year C corporation,had taxable

Q110: Nancy is a 40% shareholder and president

Q123: What is the annual required estimated tax

Q124: What is the purpose of Schedule M-3?

Q125: Explain the rules regarding the accounting periods

Q129: Briefly describe the accounting methods available for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents