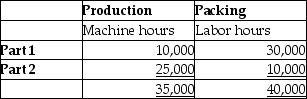

Restoration,Inc.,a leading manufacturer of antique car parts,divided its manufacturing process into two Departments - Production and Packing.The estimated overhead costs for the Production and Packing departments amounted to $14,000,000 and $20,000,000,respectively.The company produces two types of parts - Part 1 and Part 2.The total estimated labor hours for the year were 40,000,and estimated machine hours were 35,000.The Production department is mechanized,whereas the Packing department is labor oriented.Calculate departmental predetermined overhead allocation rates.

Correct Answer:

Verified

Q23: Stealth,Inc.produces two types of drones,rotary and fixed

Q24: Why is using a single plantwide predetermined

Q28: Made Well Tool,Inc.,a manufacturer of cutting

Q30: An activity-based costing system is developed in

Q34: In the first step in developing an

Q35: What is activity-based management? How is it

Q37: Activity-based costing uses a common allocation base

Q38: In the first step in developing an

Q39: Use of a single plantwide overhead rate

Q40: Reliable Car Parts,a manufacturer of spare parts,has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents