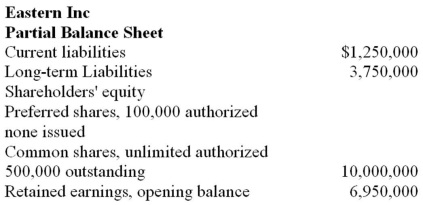

Eastern Inc is in need of $5,000,000 to expand their operations into Western Canada.The projected income statement for the first year of operation after the expansion is shown below.It does not include any of the financing costs.A projected partial balance sheet after the expansion, but before the addition of the new financing, has also been prepared.Eastern is considering three alternatives to raise the $5,000,000.

i) Borrow the full amount from the bank in the form of a long-term note.Interest would be 8% per annum, and repayments would start in two years.

ii) Issue common shares; the recent average market price has been $50.For the last three years they have paid annual dividends of $0.10 per share.

iii) Issue cumulative preferred shares with a $2 annual dividend at $80 per share. Eastern Inc

Projected Income Statement

Required:

Required:

A) Calculate the net income for Eastern under each of the three alternatives.

B) Calculate the EPS and ROE for Eastern under each of the three alternatives.Use year-end balances in your calculations.

C) Which alternative would you recommend to them? Support your recommendation.

Correct Answer:

Verified

(2) New preferred shares $5,000,000/80 ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q94: Which of the following actions would cause

Q95: The dividend payout for Braddock is:

A)14.71%

B)20.0%

C)1.56%

D)5.27%

Q96: Which of the following actions would cause

Q97: Three Sisters' Catering operates as a partnership.When

Q98: Which of the following is not included

Q99: The ROE for Braddock is closest to:

A)17.4%

B)18.0%

C)21.3%

D)24

Q100: Which of the following would result in

Q101: Dauphin Inc granted 100,000 stock options to

Q102: Complete the following table by indicating whether

Q104: Brandon Corporation currently has total shareholders' equity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents