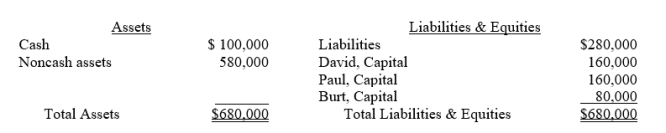

David, Paul, and Burt are partners in a CPA firm sharing profits and losses in a ratio of 2:2:3, respectively.Immediately prior to liquidation, the following balance sheet was prepared:

Required:

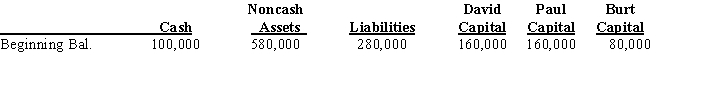

Assuming the noncash assets are sold for $160,000, determine the amount of cash to be distributed to each partner assuming all partners are personally solvent.Complete the worksheet and clearly indicate the amount of cash to be distributed to each partner in the spaces provided.

Correct Answer:

Verified

Q1: The first step in the liquidation process

Q7: Offsetting a partner's loan balance against his

Q18: The partnership of Mick, Keith, and

Q19: The partnership of Larry, Moe, and

Q20: The partnership of Peter, Paul, and

Q22: The December 31, 2013, balance sheet

Q23: To what extent can personal creditors seek

Q24: Lennon, Newman, and Ott operate the

Q25: The trial balance for the ABC

Q26: Why does a debit balance in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents