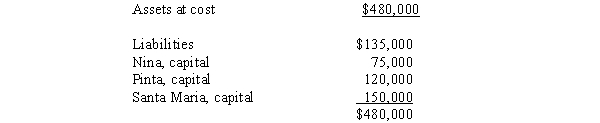

The balance sheet for the partnership of Nina, Pinta, and Santa Maria at January 1, 2014 follows.The partners share profits and losses in the ratio of 3:2:5, respectively.  Nina is retiring from the partnership.By mutual agreement, the assets are to be adjusted to their fair value of $540,000 at January 1, 2014.Pinta and Santa Maria agree that the partnership will pay Nina $135,000 cash for hers her partnership interest.There is no goodwill is to be recorded.What is the balance of Pinta's capital account after Nina's retirement?

Nina is retiring from the partnership.By mutual agreement, the assets are to be adjusted to their fair value of $540,000 at January 1, 2014.Pinta and Santa Maria agree that the partnership will pay Nina $135,000 cash for hers her partnership interest.There is no goodwill is to be recorded.What is the balance of Pinta's capital account after Nina's retirement?

A) $138,000

B) $108,000

C) $120,000

D) $132,000

Correct Answer:

Verified

Q2: Bob and Fred form a partnership and

Q21: The following balance sheet information is for

Q22: What are some of the methods commonly

Q23: Donkey desires to purchase a one-fourth capital

Q24: Rodgers and Michael formed a partnership on

Q26: Describe the tax treatment of partnership income.

Q27: The partnership of Gamma, Ginger, and

Q28: Garlic, Pepper, and Salt are partners in

Q29: The partnership of Ned, Fred, and

Q30: Letterman and Conan are partners who share

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents