Use the information below to (a) translate the year-end financial statements of Perfect Company, the foreign subsidiary, using the temporal method, and (b) prepare a schedule to compute the translation gain or loss for Perfect Company.Round numbers to the nearest dollar.

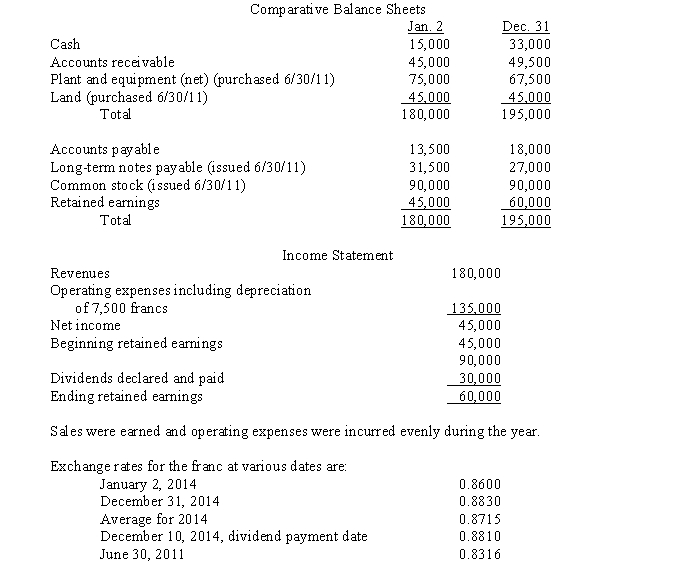

On January 2, 2014, Design Inc., a U.S.parent company, purchased a 100% interest in Perfect Company, a subdivision located in Switzerland.The purchase method of accounting was used to account for the acquisition.The 2014 financial statements for Perfect Company, the subsidiary, in Swiss francs were as follows:

Correct Answer:

Verified

Q28: Dakota, Inc.owns a company that operates in

Q29: Under the current rate method, describe how

Q29: To accomplish the objectives of translation, two

Q30: The translation process can be done using

Q31: Which method of translation is used to

Q32: Assuming that the temporal method is used,

Q33: January 1, 2014, Roswell Systems, a U.S.-based

Q34: Using the information provided in Problem use

Q35: Define remeasurement.

Q37: What requirements must be satisfied if a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents