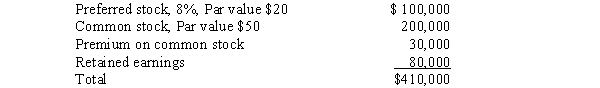

On January 1, 2013, Pippert Company acquired 80% of Skyler Company's common stock for $210,000 and 70% of Skyler's preferred stock for $80,000.Skyler Company reported the following stockholders' equity on this date:

The preferred stock is cumulative, nonparticipating, and callable at 104% of par value plus dividends in arrears.On January 1, 2013, dividends were in arrears for one year.Any difference between the implied value of the preferred stock and its book value interest is to be allocated to other contributed capital.

Changes in Skyler Company's retained earnings during 2013 and 2014 were as follows:

Required:

A.Compute the difference between the implied value and book value interest acquired for the investment in preferred stock.

B.Compute the balance in the Investment in Preferred Stock account on December 31, 2014.

C.Compute the amount of Skyler Company's net income that will be included in the controlling interest in consolidated net income for 2014.

Correct Answer:

Verified

Q12: The parent company records the receipt of

Q16: Use the following information to answer Questions

Q17: Use the following information to answer Questions

Q18: On January 1, 2013, Pale Company has

Q20: Pointe Company purchased bonds from Sentient Company

Q22: Use the following information to answer Questions

Q23: An outside party issued a note to

Q24: Allocating the gain or loss on constructive

Q25: Define "constructive retirement of debt." How is

Q26: On January 1, 2013, Prosser Company acquired

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents