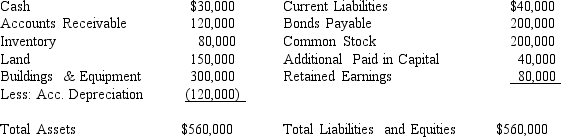

Company purchased 40% of Snuggie Corporation on January 1, 2014 for $150,000.Snuggie Corporation's balance sheet at the time of acquisition was as follows:

During 2014, Snuggie Corporation reported net income of $30,000 and paid dividends of $9,000.The fair values of Snuggie's assets and liabilities were equal to their book values at the date of acquisition, with the exception of Building and Equipment, which had a fair value of $35,000 above book value.All buildings and equipment had a remaining useful life of five years at the time of the acquisition.The amount attributed to goodwill as a result of the acquisition in not impaired.

Required:

A.What amount of investment income will Pinta record during 2014 under the equity method of accounting?

B.What amount of income will Pinta record during 2014 under the cost method of accounting?

C.What will be the balance in the investment account on December 31, 2014 under the cost and equity method of accounting?

Correct Answer:

Verified

Q34: Use the following information to answer questions

Q35: Prune Company purchased 80% of the outstanding

Q36: Pure Company acquired 80% of the outstanding

Q37: On January 1, 2014, Pioneer Company

Q38: How are dividends declared and paid by

Q40: P Company purchased 90% of the

Q41: What do potential voting rights refer to,

Q42: A principal limitation of consolidated financial statements

Q43: In the preparation of a consolidated statement

Q44: Is the recognition of a deferred tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents