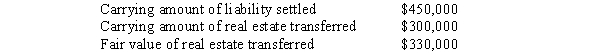

The following information pertains to the transfer of real estate in regards to a troubled debt restructuring by North Co.to Bell Co.in full settlement of North's liability to Bell:  What amount should Bell report as a gain or (loss) on restructuring?

What amount should Bell report as a gain or (loss) on restructuring?

A) $120,000 ordinary loss.

B) $120,000 extraordinary loss.

C) $150,000 ordinary loss.

D) $150,000 extraordinary loss.

Correct Answer:

Verified

Q1: Assets transferred by the debtor to a

Q2: Lyme Corporation entered into a troubled debt

Q7: When a secured claim is not fully

Q10: When fresh-start reporting is used according to

Q12: The following information pertains to the transfer

Q13: When a business becomes insolvent, it generally

Q14: The duties of the trustee include:

A) appointing

Q17: A bankruptcy petition filed by a firm

Q18: A Statement of Affairs is a report

Q20: Which statement with respect to gains and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents