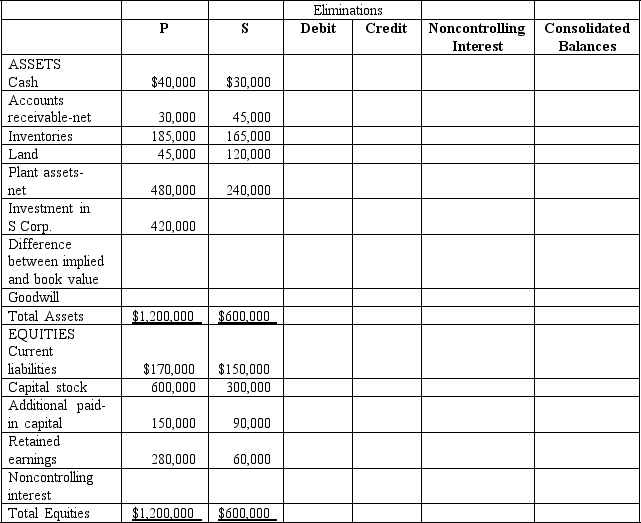

P Corporation paid $420,000 for 70% of S Corporation's $10 par common stock on December 31, 2013, when S Corporation's stockholders' equity was made up of $300,000 of Common Stock, $90,000 of Other Contributed Capital and $60,000 of Retained Earnings.S's identifiable assets and liabilities reflected their fair values on December 31, 2013, except for S's inventory which was undervalued by $60,000 and their land which was undervalued by $25,000.Balance sheets for P and S immediately after the business combination are presented in the partially completed work-paper below.

Required:

Complete the consolidated balance sheet workpaper for P Corporation and Subsidiary.

Correct Answer:

Verified

Q24: On December 31, 2013, Pinta Company purchased

Q25: Use the following information to answer questions

Q26: On January 1, 2013, Prima Corporation acquired

Q27: Use the following information to answer questions

Q28: P Company purchased 80% of the outstanding

Q29: Prepare in general journal form the workpaper

Q30: The primary beneficiary of a variable interest

Q30: Use the following information to answer questions

Q33: On December 31, 2013, Priestly Company purchased

Q34: P Company acquired 54,000 shares of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents