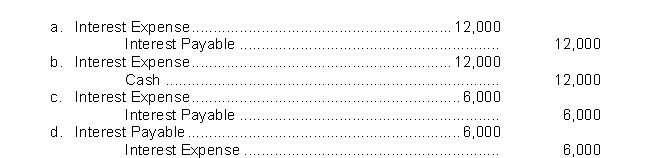

West County Bank agrees to lend Drake Builders Company $400,000 on January 1. Drake Builders Company signs a $400,000, 6%, 6-month note. What is the adjusting entry required if Drake Builders Company prepares financial statements on March 30?

Correct Answer:

Verified

Q52: Interest expense on an interest-bearing note is

A)

Q55: With an interest-bearing note the amount of

Q59: As interest is recorded on an interest-bearing

Q71: Moss County Bank agrees to lend the

Q74: Moss County Bank agrees to lend the

Q75: On October 1, Sam's Painting Service borrows

Q75: Sales taxes collected by a retailer are

Q80: Unearned Rent Revenue is

A) a contra account

Q100: The interest charged on a $350,000 note

Q110: Norlan Company does not ring up sales

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents