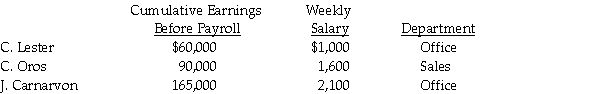

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

a)FICA: OASDI,6.2% on a limit of $117,000;Medicare,1.45%.

b)Federal income tax is 15% of gross pay.

c)Each employee pays $20 per week for medical insurance.

Correct Answer:

Verified

Q1: Why would a company use a separate

Q15: The debit amount to Payroll Tax Expense

Q16: What type of account is Payroll Tax

Q19: When a business starts, what must it

Q20: Plymouth Sharks Hockey Accessories had the

Q22: Using the information provided below,prepare a journal

Q24: Payroll information for Kinzer's Interior Decorating

Q24: The payroll tax expense is recorded at

Q26: A banking day is any day that

Q34: The balance in the Wages and Salaries

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents