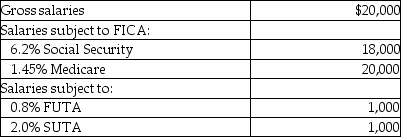

Bob's Cake House's payroll for April includes the following data:

The employer's payroll tax for the period would be:

A) $1,558.

B) $1,434.

C) $1,935.

D) $2,090.

Correct Answer:

Verified

Q106: As the Prepaid Workers' Compensation is recognized,

Q108: A FUTA tax credit:

A) is given to

Q110: Workers' compensation insurance is deducted from employees'

Q110: Carl's earnings during the month of March

Q111: Which of the following would NOT typically

Q112: Kate's earnings during the month of May

Q112: Workers' compensation provides insurance for employees who

Q114: When calculating the employer's payroll tax expense,

Q120: An employer can reduce the federal unemployment

Q120: Sue's Jewelry Shoppe's July payroll includes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents