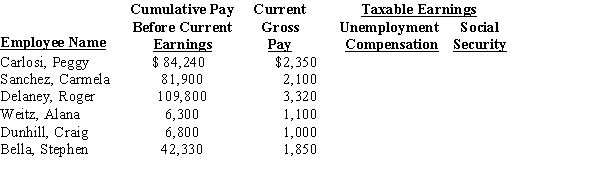

Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $110,100 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Calculate the amount of taxable earnings for unemployment and Social Security taxes, and prepare the journal entry to record the employer's payroll taxes as of September 28, 20--.

Correct Answer:

Verified

Q65: The adjustment to journalize an additional premium

Q73: The cost of workers' compensation insurance for

Q83: Match the terms with the definitions.

-Employer's Annual

Q84: Match the terms with the definitions.

-A number

Q85: Match the terms with the definitions.

-Provides insurance

Q86: Match the terms with the definitions.

-A tax

Q87: Match the terms with the definitions.

-Employer's Quarterly

Q88: Match the terms with the definitions.

-A system

Q91: Match the terms with the definitions.

-Employee's Wage

Q95: Match the terms with the definitions.

-The net

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents