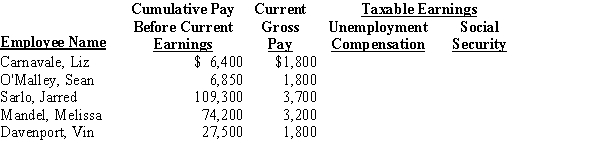

From the following information from the payroll register of Veronica's Auto Supply Store, calculate the amount of taxable earnings for unemployment and FICA tax, and prepare the journal entry to record the employer's payroll taxes as of April 30, 20--. Social Security tax is 6.2% on the first $94,200 of earnings for each employee. Medicare tax is 1.45% of gross earnings. FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings.

Correct Answer:

Verified

Q61: Anthony Pescador owns Sundance Florist.He does his

Q75: Mark Turney owns Creative Corners.He does his

Q81: Match the terms with the definitions.

-A tax

Q83: Match the terms with the definitions.

-Employer's Annual

Q85: Match the terms with the definitions.

-Provides insurance

Q87: Match the terms with the definitions.

-Employer's Quarterly

Q89: Match the terms with the definitions.

-Transmittal of

Q92: Match the terms with the definitions.

-A contribution

Q94: Match the terms with the definitions.

-An electronic

Q96: Match the terms with the definitions.

-Taxes levied

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents