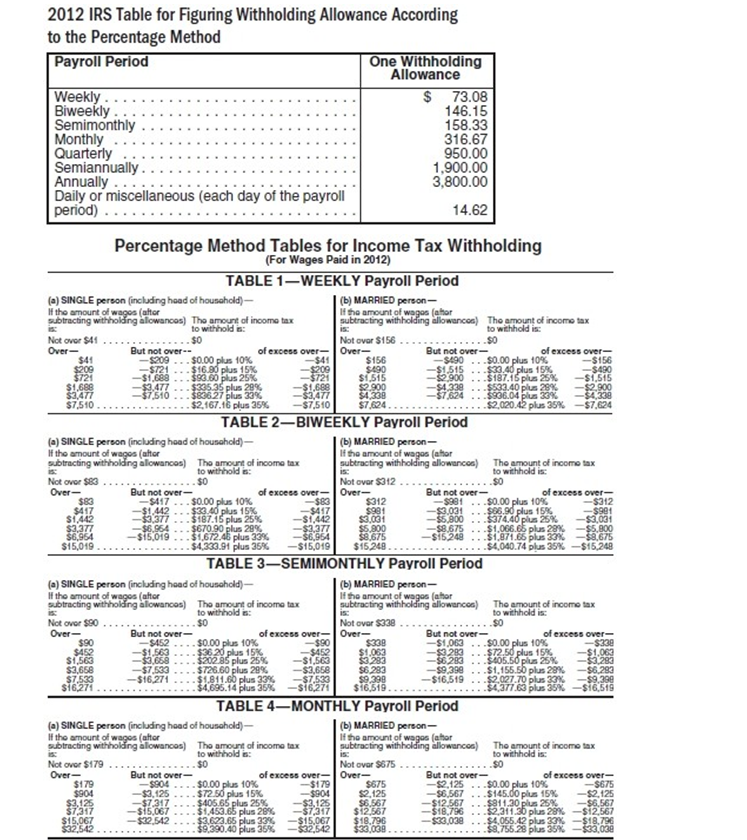

-Derek Daniels earns $22,312.15 monthly, is married, and claims 3 withholding allowances. Find his net earnings for this pay period. FICA tax is 4.2% and Medicare tax is 1.45%.

A) $17,409.90

B) $21,051.51

C) $16,149.26

D) $25,953.76

Correct Answer:

Verified

Q36: The amount of federal income tax withheld

Q37: Employers are required to pay SUTA quarterly

Q38: If employees are paid weekly, they will

Q39: FUTA tax must be paid:

A) six times

Q40: A salaried employee is paid the same

Q42: Social Security tax and Medicare tax are:

A)

Q43: A withholding allowance, also called an exemption,

Q44: To find the gross amount of a

Q45: Employees who are paid based on the

Q46: The employer is required to match the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents