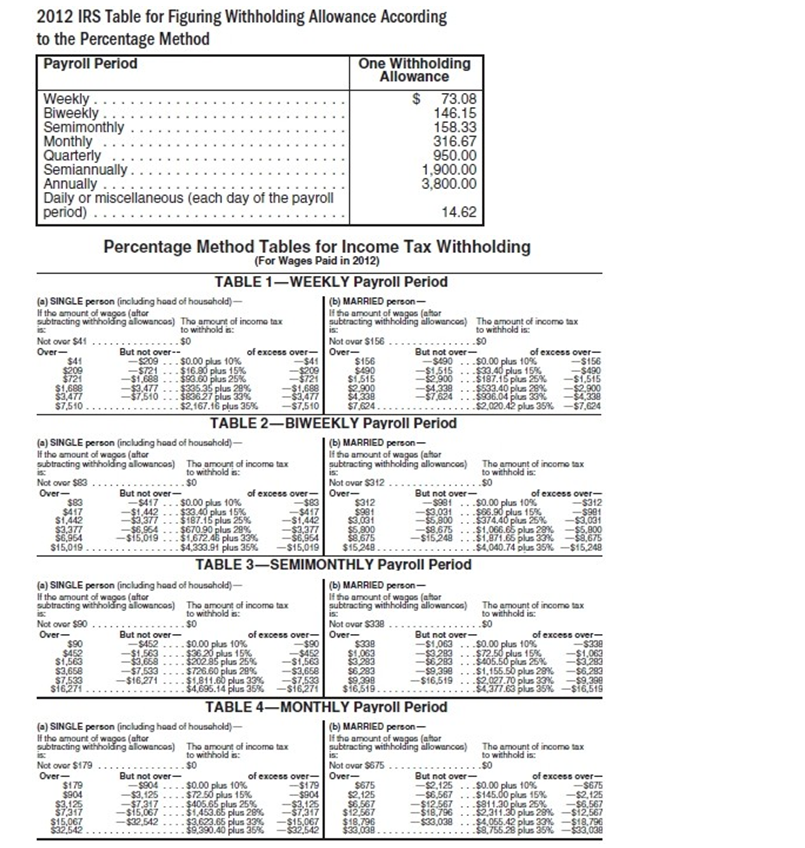

-Robert Young earns a weekly salary of $603.16 with no adjustments to income. He is married and claims 3 withholding allowances. Find the federal tax withholding to be deducted from his weekly paycheck using the percentage method tables.

A) $38.39

B) $22.79

C) $44.72

D) $60.32

Correct Answer:

Verified

Q66: Yolanda, whose regular rate of pay is

Q67: Juan earns a weekly salary of $820.00

Q68: Stephen assembles and finishes wood products. He

Q69: Ellen earns a salary of $15,964 annually

Q70: Q72: Q73: Holly, whose regular rate of pay is Q74: Naomi Haden earns a weekly salary of Q75: Q76: Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

![]()

![]()

![]()