Multiple Choice

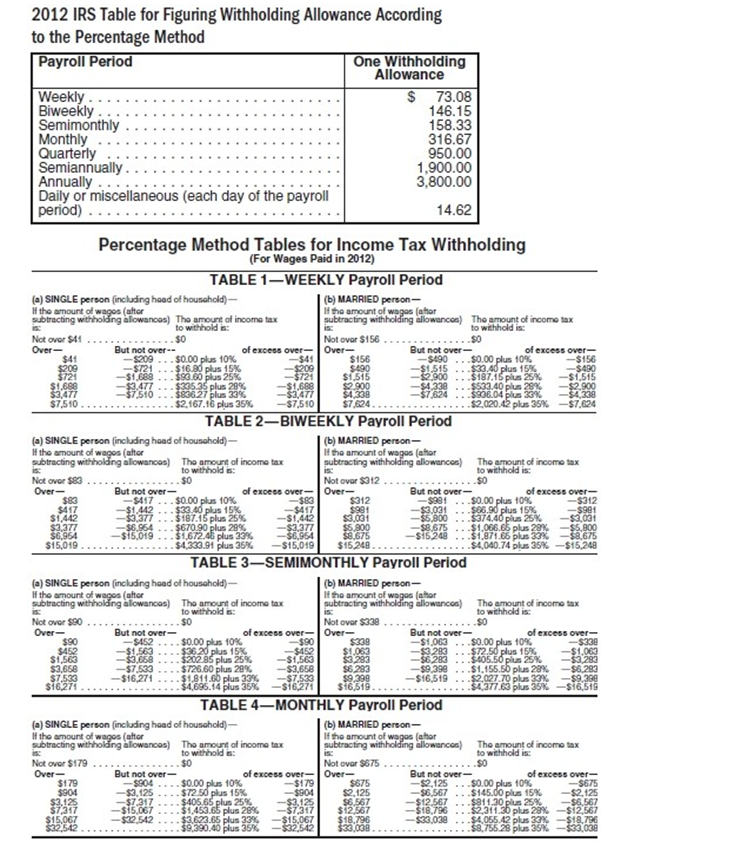

-Kevin Mondale earns a monthly salary of $22,612.15. He has a $300 adjustment-to-income flexible benefits package, is married, and claims 4 withholding allowances. Find the federal tax withholding to be deducted from his monthly paycheck using the percentage method tables.

A) $4797.75

B) $4896.75

C) $5215.75

D) $11,000.43

Correct Answer:

Verified

Related Questions