Multiple Choice

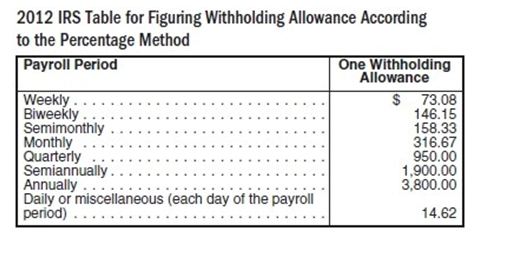

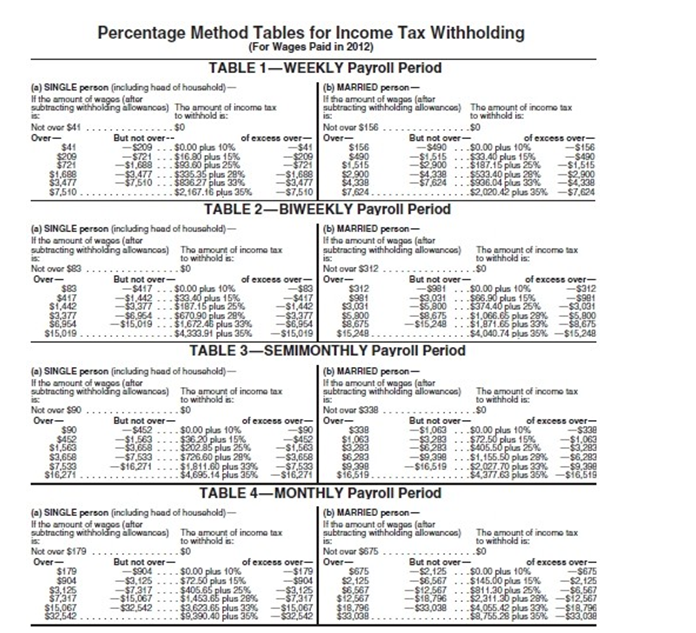

-Irene Farley earns a semimonthly salary of $7714.27. She has a $100 adjustment-to-income flexible benefits package, is married, and claims 4 withholding allowances. Find the federal tax withholding to be deducted from her semimonthly paycheck using the percentage method tables.

A) $3110.17

B) $1350.93

C) $1378.93

D) $1528.26

Correct Answer:

Verified

Related Questions