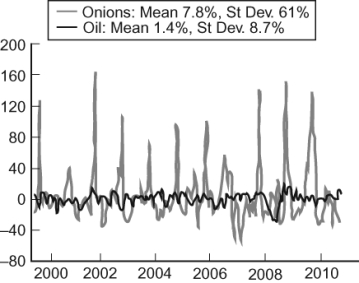

Figure: Price Changes  The figure (from Global Financial Data, EIA) illustrates in percentage terms how the price of onions (in gray) and crude oil (in black) fluctuate over time. The price of onions clearly fluctuates more than oil. In 1958, the United States Congress banned future markets on onions. How does this historical fact explain the difference in deviation between oil and onions?

The figure (from Global Financial Data, EIA) illustrates in percentage terms how the price of onions (in gray) and crude oil (in black) fluctuate over time. The price of onions clearly fluctuates more than oil. In 1958, the United States Congress banned future markets on onions. How does this historical fact explain the difference in deviation between oil and onions?

A) The ban prevented analysts from buying and selling based on the price of onions' current supply and demand.

B) The ban encouraged speculation on the onion, causing its price to fluctuate widely as different bubbles grew and popped.

C) The ban destroyed any incentive for market participants to understand the onion industry.

D) The ban forced market participants to buy and sell based solely on current supply and demand.

Correct Answer:

Verified

Q146: With speculation, prices:

A) become less volatile than

Q147: When they guess correctly about price movements,

Q148: Futures:

A) require people to be present in

Q151: Speculators:

A) help stabilize prices over time.

B) profit

Q153: Tyler buys a futures contract from Alex

Q154: Use the following to answer question 154:

Figure:

Q170: A spot market allows for the exchange

Q173: Speculation tends to _ market welfare.

A) increase

B)

Q175: If people suddenly expect that a severe

Q178: Speculators:

A) generally cause prices to rise.

B) generally

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents