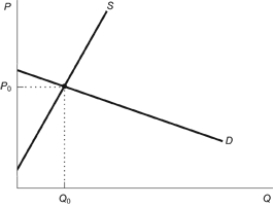

Figure: Commodity Tax with Elastic Demand  According to the figure, who bears the greater burden of a commodity tax?

According to the figure, who bears the greater burden of a commodity tax?

A) The buyer will bear the greater burden of the tax.

B) The seller will bear the greater burden of the tax.

C) The buyer and the seller will split the tax burden equally.

D) The government will bear the full burden of the tax.

Correct Answer:

Verified

Q60: Use the following to answer questions:

Figure: Tax

Q66: If the elasticity of supply is 1,

Q68: If a tax is imposed on a

Q71: Buyers bear a greater share of a

Q72: If the elasticity of demand is 1

Q73: Andy and Annie are in a happy

Q75: The price paid by buyers minus the

Q76: Which of the following statements is correct?

A)

Q77: _ determine(s) whether buyers or sellers ultimately

Q79: Which of the following is a correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents