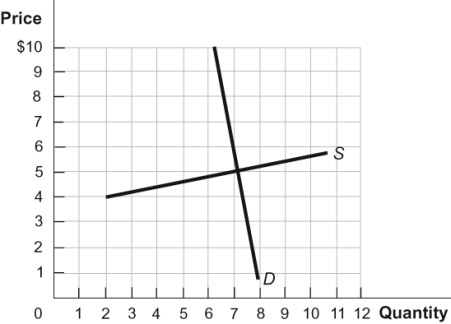

Figure: Supply and Demand  If the government places a tax on sellers of $0.67 per unit in this market, who will bear the burden of the tax?

If the government places a tax on sellers of $0.67 per unit in this market, who will bear the burden of the tax?

A) Sellers will pay 100 percent of the tax in the form of lower prices.

B) The tax will be split 50-50 between sellers and buyers.

C) Buyers will pay the majority of the tax.

D) Sellers will pay the majority of the tax.

Correct Answer:

Verified

Q64: On June 23, 2011, Honduras announced new

Q69: What do subsidies and commodity taxes have

Q81: Suppose the demand for pizza is inelastic

Q82: Who bears most of the burden of

Q85: When a payroll tax is enacted or

Q87: When supply is more elastic than demand,

A)

Q92: Let the price elasticity of supply for

Q95: When demand is more elastic than supply,

A)

Q96: Which of the following statements is TRUE?

A)

Q100: Which of the following statements is TRUE

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents