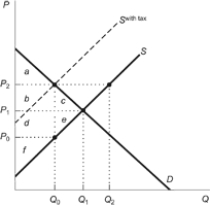

Figure: Commodity Tax

Use the figure to answer the following questions.

a. What is the size of the tax?

b. What is the equilibrium quantity before the tax?

c. What is the equilibrium quantity with the tax?

d. What is the price consumers pay before taxes?

e. What is the price consumers pay with the tax?

f. What is the price sellers receive before taxes?

g. What is the price sellers receive with the tax?

h. What is the deadweight loss of the tax?

i. What is the government tax revenue?

j. What is consumer surplus before the tax?

k. What is consumer surplus with the tax?

l. What is producer surplus before the tax?

m. What is producer surplus with the tax?

Correct Answer:

Verified

b. Q1

c. Q0

d. P...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q201: Suppose the government is attempting to discourage

Q202: The government paying farmers to plant more

Q205: A market is described by the equations

Q208: Unlike taxes, who gets the subsidy depends

Q209: Subsidies must ultimately be paid for through

Q210: Figure: Supply and Demand with Tax on

Q211: A market is described by the equations

Q214: Ceteris paribus, the more elastic the supply

Q215: When the federal government provided a subsidy

Q216: Subsidies lead to the existence of nonbeneficial

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents