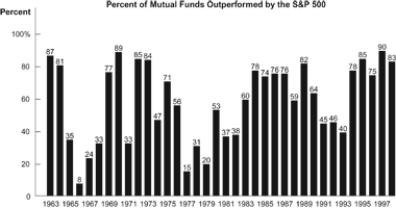

Figure: Mutual Funds  Refer to the figure. From this Mutual Funds figure (John Stossel dart-throwing experiment) we can say that:

Refer to the figure. From this Mutual Funds figure (John Stossel dart-throwing experiment) we can say that:

A) mutual funds typically outperform the S&P 500.

B) mutual fund managers are no smarter than monkeys.

C) knowledge of stock market behavior does not guarantee its predictability.

D) mutual funds can never outperform the stock market.

Correct Answer:

Verified

Q21: Which refers to a mutual fund for

Q22: According to the efficient markets hypothesis, stock

Q25: Which is helpful in stock investment strategies?

A)

Q27: Over a 10-year span, the S&P 500

Q31: The efficient markets hypothesis implies that in

Q32: The text argues that which statement is

Q35: Which of the following is TRUE of

Q37: Which of the following statements is TRUE?

I.

Q38: The fact that the majority of stock

Q40: A mutual fund pools money from many

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents