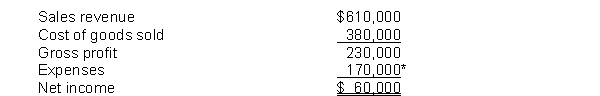

The income statement for Dibble Company for the year ended December 31, 2014 appears below.  *Includes $20,000 of interest expense and $22,000 of income tax expense.

*Includes $20,000 of interest expense and $22,000 of income tax expense.

Additional information:

1. Ordinary shares outstanding on January 1, 2014 were 40,000 shares. On July 1, 2014, 10,000 more shares were issued.

2. The market price of Dibble's shares was $12 at the end of 2014.

3. Cash dividends of $30,000 were paid, $6,000 of which were paid to preference shareholders.

Instructions

Compute the following ratios for 2014:

(a) earnings per share.

(b) price-earnings ratio.

(c) times interest earned.

Correct Answer:

Verified

Q202: _ analysis also called trend analysis is

Q203: Times interest earned is calculated by dividing

Q206: Selected comparative statement data for Willingham Products

Q206: Hansen Corporation had net income for the

Q207: Gumble Corporation had income from continuing operations

Q208: The ratios used in evaluating a company's

Q211: The accounts receivable turnover is calculated by

Q212: Winfrey Corporation gathered the following information for

Q214: The lower the _ to _ ratio

Q218: The _ ratio measures the percentage of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents