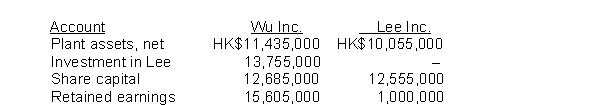

Wu Inc. Purchased 100% of the ordinary shares of Lee Inc. on December 31, 2014. The cost of the investment exceeded the book value of the subsidiary's net assets by HK$200,000. The fair value of Lee's plant assets at December 31, 2014 is HK$10,255,000. Selected account balances from the separate statements of financial position of Wu and Royal on December on December 31, 2014 are as follows:  The amount of plant assets, net reported on the consolidation statement of financial position at December 31, 2014 is

The amount of plant assets, net reported on the consolidation statement of financial position at December 31, 2014 is

A) HK$21,690,000.

B) HK$21,490,000.

C) HK$11,635,000.

D) HK$11,435,000.

Correct Answer:

Verified

Q110: When preparing a consolidated income statement,

A)only the

Q115: A consolidated income statement will show

A)revenue and

Q142: Daniel Corporation acquired 100% of the ordinary

Q143: Wellington Company purchased 100% of the ordinary

Q144: Balances which must be eliminated in preparing

Q145: Wellington Company purchased 100% of the ordinary

Q145: Which of the following reasons best explains

Q148: Non-trading securities are classified as

A) short-term investments

Q150: Wellington Company purchased 100% of the ordinary

Q153: An unrealized gain or loss on non-trading

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents