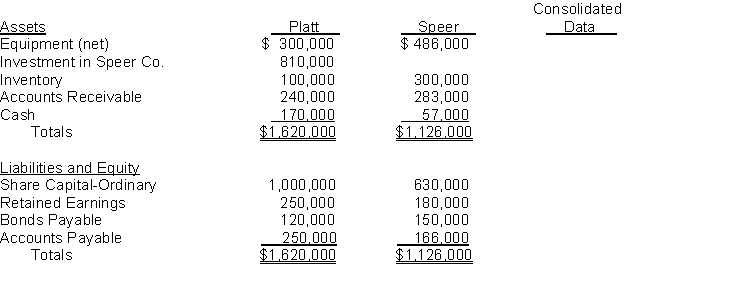

*The separate statements of financial position of Platt Company and its wholly owned subsidiary, Speer Company, as of the date of acquisition are shown below:  Instructions

Instructions

Provide the amount that should appear in the Consolidated Data column for each of the selected accounts. If the account should not appear in the Consolidated Data column, indicate "None." Assume that all accounts have normal balances and that Speer Company shares were acquired for cash at a price equal to its book value.

Correct Answer:

Verified

Q164: An unrealized loss on trading securities is

Q172: Under the cost method dividends received from

Q202: The Fair Value Adjustment account is a

Q203: A company that owns more than 50%

Q205: When an investor owns between 20% and

Q207: Match of the following

Q210: At the end of an accounting period,

Q212: When a year-end adjustment is made to

Q214: At the beginning of the year, Grant

Q219: What purposes are served by reporting Unrealized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents