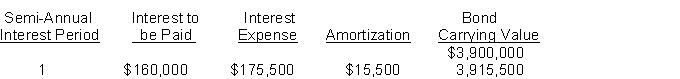

On June 30, 2014, Wayne, Inc. sold $4,000,000 (face value) of bonds. The bonds are dated June 30, 2014, pay interest semiannually on December 31 and June 30, and will mature on June 30, 2017. The following schedule was prepared by the accountant for 2014.  Instructions

Instructions

On the basis of the above information, answer the following questions. (Round your answer to the nearest dollar or percent.)

1. What is the stated interest rate for this bond issue?

2. What is the market interest rate for this bond issue?

3. What was the selling price of the bonds as a percentage of the face value?

4. Prepare the journal entry to record the sale of the bond issue on June 30, 2014.

5. Prepare the journal entry to record the payment of interest and amortization on December 31, 2014.

Correct Answer:

Verified

Q182: If bonds are issued at face value

Q203: The straight-line method of amortization allocates the

Q207: A method of amortizing bond discount or

Q209: Sales taxes collected from customers are a

Q290: Wenger Corporation is issuing €700,000 of

Q297: Vance Company issued $1,000,000, 10%, 20-year

Q299: Liabilities are classified on the statement of

Q301: Bonds may be redeemed (retired) before maturity

Q302: Kim Estes and Jeff Malone are discussing

Q304: The joint projects of the FASB and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents