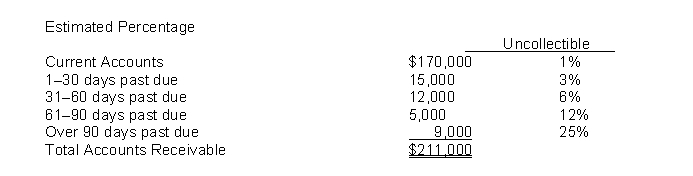

Moore Company had a $700 credit balance in Allowance for Doubtful Accounts at December 31, 2014, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following:  Instructions

Instructions

(a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense.

(b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts.

(c) Assume that the company has a policy of providing for bad debts at the rate of 1% of sales, that sales for 2014 were $500,000, and that Allowance for Doubtful Accounts had a $650 credit balance before adjustment. Prepare the adjusting entry for the current year's provision for bad debts.

Correct Answer:

Verified

Allowance for...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q226: Kosko Furniture Store has credit sales of

Q228: Newman Stores accepts both its own and

Q229: Remington Company had the following select transactions.

Q231: Prepare the necessary journal entry for the

Q232: Ripken Supply Co. has the following transactions

Q233: Compute the missing amount for each of

Q236: Compute the maturity date and interest for

Q236: Listed below are two independent situations involving

Q237: The income statement approach to estimating uncollectible

Q238: Nolte Products is undecided about which basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents