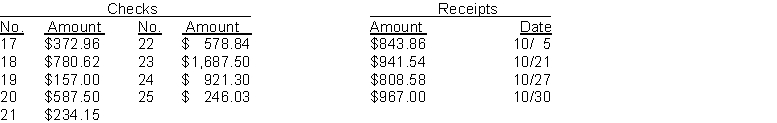

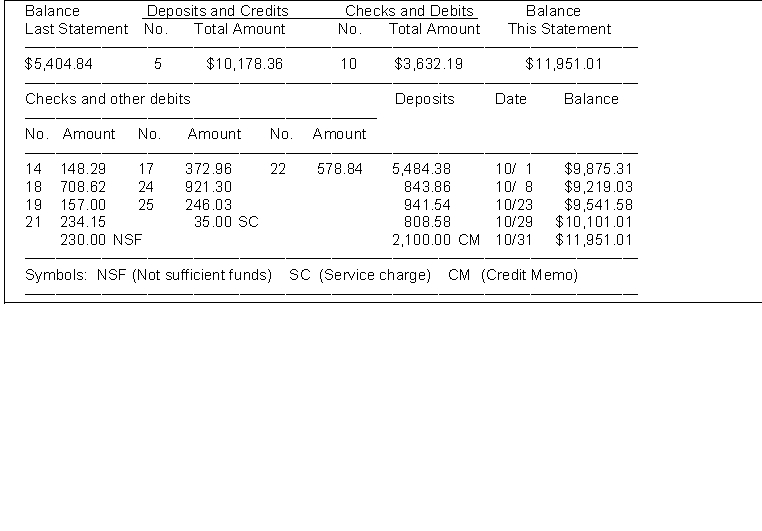

The cash balance per books for Feagen Company on September 30, 2014 is $10,740.93. The following checks and receipts were recorded for the month of October, 2014:  In addition, the bank statement for the month of October is presented below:

In addition, the bank statement for the month of October is presented below:  Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. Long, a customer, in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $60 which has not been accrued. The bank service charge is $35.00.

Check No. 18 was correctly written for $708.62 for a payment on account. The NSF check was from S. Long, a customer, in settlement of an accounts receivable. An entry had not been made for the NSF check. The credit memo is for the collection of a note receivable including interest of $60 which has not been accrued. The bank service charge is $35.00.

Instructions

(a) Prepare a bank reconciliation at October 31.

(b) Prepare the adjusting journal entries required by the bank reconciliation.

Correct Answer:

Verified

Q194: Fraud experts often say that there are

Q203: A voucher is recorded in the _

Q211: Two limitations of systems of internal control

Q215: Dillman Food Store developed the following information

Q216: Using the code letters below, indicate how

Q218: The following adjusting entries for Pare Company

Q220: Compute Whyte Company's adjusted cash balance per

Q221: Identify the three activities that pertain to

Q227: A check correctly written for $270 was

Q252: Important objectives of a system of internal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents