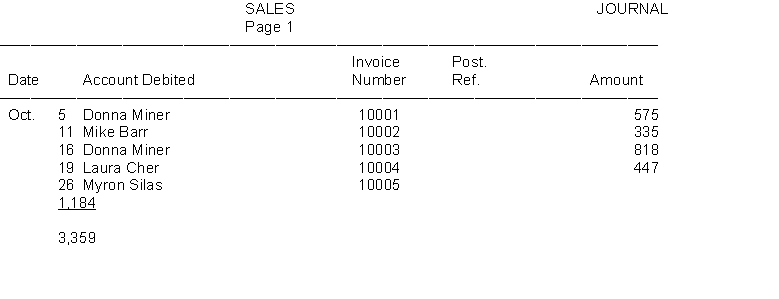

Easton Company began business on October 1. The sales journal, as it appeared at the end of the month, follows:

1. Open general ledger T-accounts for Accounts Receivable (No. 112) and Sales Revenue (No. 401) and an accounts receivable subsidiary T-account ledger with an account for each customer. Make the appropriate postings from the sales journal. Fill in the appropriate posting references in the sales journal above.

2. Prove the accounts receivable subsidiary ledger by preparing a schedule of accounts receivable.

Correct Answer:

Verified

2. SCHED...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Internal control over payroll is not necessary

Q32: FICA taxes and federal income taxes are

Q75: Entries in the cash payments journal are

Q97: The reference column of the accounts in

Q115: Which one of the following payroll taxes

Q116: Gates Company maintains four special journals and

Q117: Horton Company uses four special journals, (cash

Q118:

Q121: Match the items below by entering the

Q128: Transactions that cannot be entered in a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents