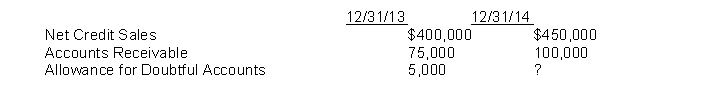

Coffeldt Sign Company uses the allowance method in accounting for uncollectible accounts. Past experience indicates that 1% of net credit sales will eventually be uncollectible. Selected account balances at December 31, 2013, and December 31, 2014, appear below:  Instructions

Instructions

(a) Record the following events in 2014.

Aug. 10 Determined that the account of Sue Lang for $1,000 is uncollectible.

Sept. 12 Determined that the account of Tom Woods for $4,000 is uncollectible.

Oct. 10 Received a check for $550 as payment on account from Sue Lang, whose account had previously been written off as uncollectible. She indicated the remainder of her account would be paid in November.

Nov. 15 Received a check for $450 from Sue Lang as payment on her account.

(b) Prepare the adjusting journal entry to record the bad debt provision for the year ended December 31, 2014.

(c) What is the balance of Allowance for Doubtful Accounts at December 31, 2014?

Correct Answer:

Verified

Q177: The accounts receivable turnover ratio is computed

Q179: The entry to record the dishonor of

Q205: Patel Co. sells Christmas angels. Patel determines

Q206: On January 6, Stegner Co. sells merchandise

Q207: Which of the following statements concerning receivables

Q208: Compute the maturity value for each of

Q209: Record the following transactions for Turnbull Company.

1.

Q211: On February 1, Platt Company received a

Q212: On March 9, Fillmore gave Camp Company

Q214: Longbine Company's ledger at the end of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents