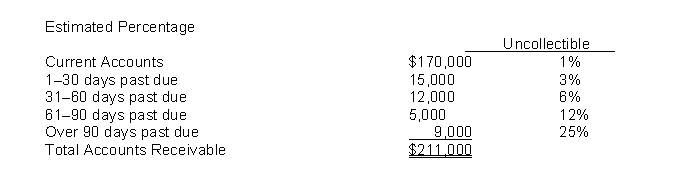

Moore Company had a $700 credit balance in Allowance for Doubtful Accounts at December 31, 2014, before the current year's provision for uncollectible accounts. An aging of the accounts receivable revealed the following:  Instructions

Instructions

(a) Prepare the adjusting entry on December 31, 2014, to recognize bad debts expense.

(b) Assume the same facts as above except that the Allowance for Doubtful Accounts account had a $500 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts.

(c) Assume that the company has a policy of providing for bad debts at the rate of 1% of sales, that sales for 2014 were $500,000, and that Allowance for Doubtful Accounts had a $650 credit balance before adjustment. Prepare the adjusting entry for the current year's provision for bad debts.

Correct Answer:

Verified

Allowance for...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q227: Compute the maturity date and interest for

Q228: Newman Stores accepts both its own and

Q229: Greig Company uses the allowance method for

Q230: An inexperienced accountant made the following entries.

Q231: Prepare the necessary journal entry for the

Q233: Compute the missing amount for each of

Q234: Prepare the necessary journal entries for the

Q235: Compute bad debts expense based on the

Q236: Listed below are two independent situations involving

Q237: The income statement approach to estimating uncollectible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents