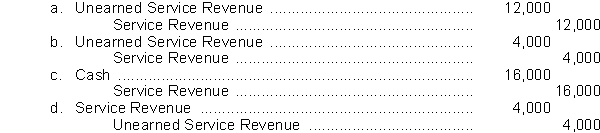

Mike Conway is a lawyer who requires that his clients pay him in advance of legal services rendered. Mike routinely credits Service Revenue when his clients pay him in advance. In June Mike collected $16,000 in advance fees and completed 75% of the work related to these fees. What adjusting entry is required by Mike's firm at the end of June?

Correct Answer:

Verified

Q157: If accounting information has relevance it is

Q159: Which of the statements below is not

Q168: An expense is recorded under the cash

Q172: Which of the following statements is not

Q173: The periodicity assumption states

A)the business will remain

Q194: Similarities between International Financial Reporting Standards (IFRS)

Q196: Becki Jean Corporation issued a one-year, 6%,

Q197: A document prepared to prove the equality

Q200: Information that is presented in a clear

Q202: Which of the following statements concerning accrual-basis

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents