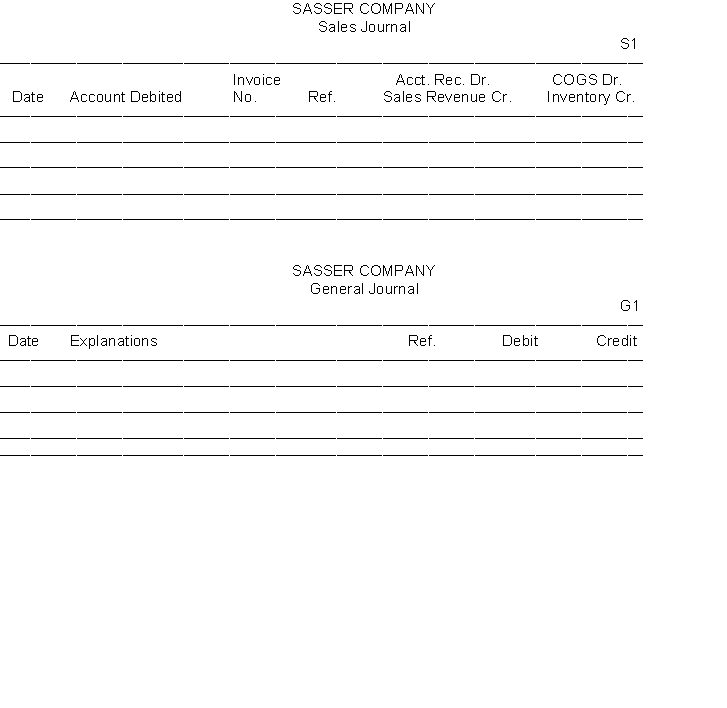

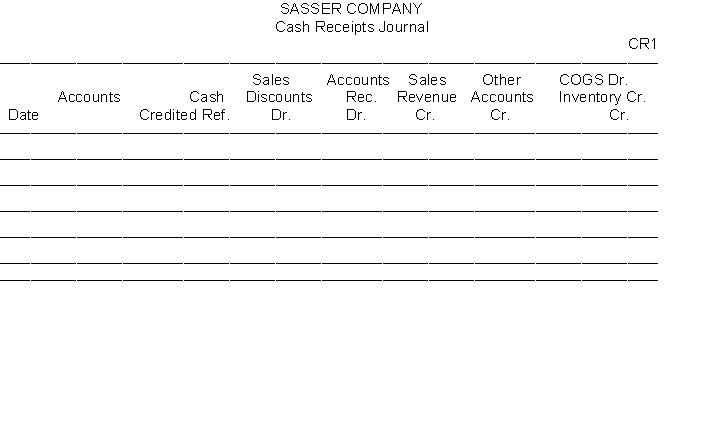

Sasser Company uses a sales journal, a cash receipts journal, and a general journal to record transactions with its customers. Record the following transactions in the appropriate journals. The cost of all merchandise sold was 70% of the sales price.

July 2 Sold merchandise for $21,000 to B. Stine on account. Credit terms 2/10, n/30. Sales invoice No. 100.

July 5 Received a check for $800 from R. Hyatt in payment of his account.

July 8 Sold merchandise to F. Wendel for $900 cash.

July 10 Received a check in payment of Sales invoice No. 100 from B. Stine minus the 2% discount.

July 15 Sold merchandise for $9,000 to J. Nott on account. Credit terms 2/10, n/30. Sales invoice No. 101.

July 18 Borrowed $25,000 cash from United Bank signing a 6-month, 10% note.

July 20 Sold merchandise for $18,000 to C. Karn on account. Credit terms 2/10, n/30. Sales invoice No. 102.

July 25 Issued a credit memorandum for $600 to C. Karn as an allowance for damaged merchandise previously sold on account.

July 31 Received a check from J. Nott for $5,000 as payment on account.

Correct Answer:

Verified

Q72: The reference column of a multiple-column cash

Q97: The reference column of the accounts in

Q112: Easton Company began business on October 1.

Q114: Circle the correct answer to each situation.

Q116: On December 1, the accounts receivable control

Q118: After Artie Company had completed all posting

Q125: If a certain type of transaction occurs

Q130: The entries in the Accounts Receivable Credit

Q131: If a company maintains special journals sales

Q136: The use of special journals often saves

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents