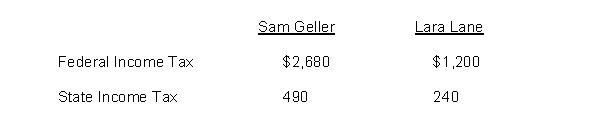

Sam Geller had earned (accumulated) salary of $99,000 through November 30. His December salary amounted to $9,000. Lara Lane began employment on December 1 and will be paid her first month's salary of $6,000 on December 31. Income tax withholding for December for each employee is as follows:  The following payroll tax rates are applicable:

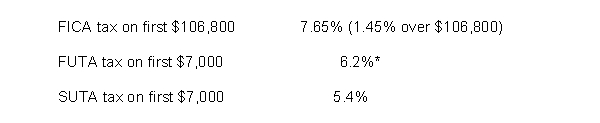

The following payroll tax rates are applicable:  *Less a credit equal to the state unemployment contribution

*Less a credit equal to the state unemployment contribution

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll.

Correct Answer:

Verified

Q11: A good internal control feature is to

Q22: Which of the following is not performed

Q23: Control over timekeeping does not include

A) having

Q106: Which of the following employees would likely

Q123: By January 31 following the end of

Q124: The journal entry to record the payroll

Q131: Most companies involved in interstate commerce are

Q142: Banner Company had the following payroll data

Q146: Match the codes assigned to the following

Q154: The tax that is paid equally by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents