29

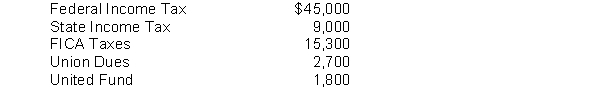

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and the employer's payroll tax expense on the payroll for January 15.

Correct Answer:

Verified

Q23: Control over timekeeping does not include

A) having

Q158: Changes in pay rates during employment should

Q215: The employer incurs a payroll tax expense

Q217: A payroll tax expense which is borne

Q265: 34

The following payroll liability accounts are included

Q267: 30

Sam Geller had earned (accumulated) salary of

Q271: 32

Diane Lane earns a salary of $9,500

Q272: Match the codes assigned to the following

Q274: 28

Ann Hech's regular hourly wage is $18

Q275: Match the items below by entering the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents