31

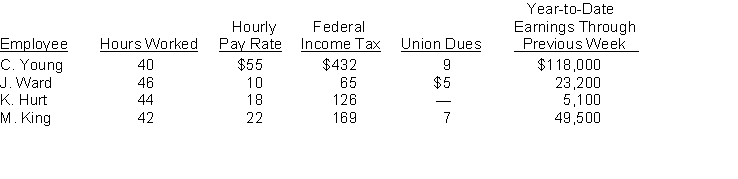

Assume that the payroll records of Erroll Oil Company provided the following information for the weekly payroll ended November 26, 2017.  Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA Tax rate is 7.65% for the first $117,000 (1.45% over $117,000) of each employee's annual earnings. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Additional information: All employees are paid overtime at time and a half for hours worked in excess of 40 per week. The FICA Tax rate is 7.65% for the first $117,000 (1.45% over $117,000) of each employee's annual earnings. The employer pays unemployment taxes of 6.2% (5.4% for state and .8% for federal) on the first $7,000 of each employee's annual earnings.

Instructions

(a) Prepare the payroll register for the pay period.

(b) Prepare general journal entries to record the payroll and payroll taxes.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Control over timekeeping does not include

A) having

Q154: The tax that is paid equally by

Q155: The effective federal unemployment tax rate is

Q205: An employee's net pay consists of gross

Q208: Two federal taxes which are levied against

Q271: 32

Diane Lane earns a salary of $9,500

Q272: Match the codes assigned to the following

Q274: 28

Ann Hech's regular hourly wage is $18

Q275: Match the items below by entering the

Q278: 33 ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents