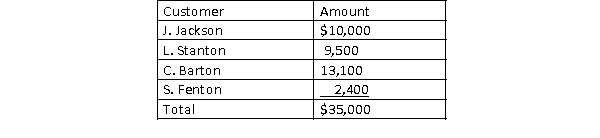

Morry Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31:

Required:  1) Journalize the write-offs for the current year under the direct write-off method.

1) Journalize the write-offs for the current year under the direct write-off method.

2) Journalize the write-offs for the current year under the allowance method. Also, journalize the adjusting entry for uncollectible receivables assuming the company made $2,400,000 of credit sales during the year and the industry average for uncollectible receivables is 1.50% of credit sales.

3) How much higher or lower would Morry Company's net income have been under the direct write-off method than under the allowance method?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q123: Discuss the (1) focus and (2) financial

Q134: Discount Mart utilizes the allowance method of

Q148: Mr. Potts issued a 90-day, 7% note

Q149: Determine the due date and amount of

Q150: For each of the following notes receivables

Q154: Journalize the following transactions for Lucite Company.

November

Q157: a) The aging of Torme Designs' accounts

Q158: Blackwell Industries received a 120-day, 9% note

Q161: At the end of the current year,

Q162: On June 30

(the end of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents