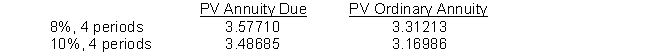

Pisa, Inc. leased equipment from Tower Company under a four-year lease requiring equal annual payments of $172,076, with the first payment due at lease inception. The lease does not transfer ownership, nor is there a bargain purchase option. The equipment has a 4-year useful life and no salvage value. Pisa, Inc.'s incremental borrowing rate is 10% and the rate implicit in the lease (which is known by Pisa, Inc.) is 8%. Pisa, Inc. uses the straight-line method to depreciate similar assets. What is the amount of depreciation expense recorded by Pisa, Inc. in the first year of the asset's life?

A) $0 because the asset is depreciated by Tower Company.

B) $142,484

C) $153,883

D) $150,000

Correct Answer:

Verified

Q58: Use the following information for questions 54

Q59: Use the following information for questions 54

Q60: Use the following information for questions 54

Q61: Pisa, Inc. leased equipment from Tower Company

Q62: Haystack, Inc. manufactures machinery used in the

Q64: Pisa, Inc. leased equipment from Tower Company

Q65: Use the following information for questions 62

Q66: Use the following information for questions 75

Q67: Use the following information for questions 75

Q68: Haystack, Inc. manufactures machinery used in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents