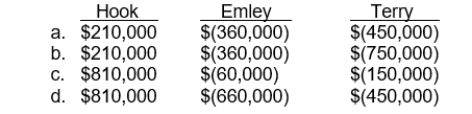

Hook Company leased equipment to Emley Company on July 1, 2014, for a one-year period expiring June 30, 2015, for $60,000 a month. On July 1, 2015, Hook leased this piece of equipment to Terry Company for a three-year period expiring June 30, 2018, for $75,000 a month. The original cost of the equipment was $4,800,000. The equipment, which has been continually on lease since July 1, 2010, is being depreciated on a straight-line basis over an eight-year period with no salvage value. Assuming that both the lease to Emley and the lease to Terry are appropriately recorded as operating leases for accounting purposes, what is the amount of income (expense) before income taxes that each would record as a result of the above facts for the year ended December 31, 2015?

Correct Answer:

Verified

Q94: What is the amount of the lessee's

Q95: Geary Co. leased a machine to Dains

Q96: Use the following information for questions 94

Q97: Lease A does not contain a bargain

Q98: Use the following information for questions 91

Q100: Harter Company leased machinery to Stine Company

Q101: sells machinery to Beck Corp. at its

Q102: Use the following information for questions 104

Q103: Lessee and lessor accounting (sale-leaseback).On January 1,

Q104: Hayes Corp. is a manufacturer of truck

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents