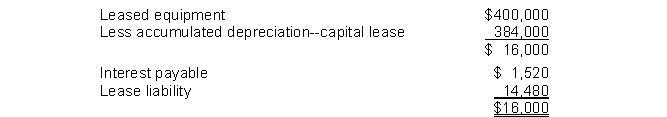

Geary Co. leased a machine to Dains Co. Assume the lease payments were made on the basis that the residual value was guaranteed and Geary gets to recognize all the profits. At the end of the lease term, before the lessee transfers the asset to the lessor, the leased asset and obligation accounts have the following balances:  If, at the end of the lease, the fair value of the residual value is $9,800, what gain or loss should Geary record?

If, at the end of the lease, the fair value of the residual value is $9,800, what gain or loss should Geary record?

A) $4,680 gain

B) $8,280 loss

C) $6,200 loss

D) $9,800 gain

Correct Answer:

Verified

Q90: Mays Company has a machine with a

Q91: On June 30, 2015, Falk Co. sold

Q92: What is the discount rate implicit in

Q93: Use the following information for questions 91

Q94: What is the amount of the lessee's

Q96: Use the following information for questions 94

Q97: Lease A does not contain a bargain

Q98: Use the following information for questions 91

Q99: Hook Company leased equipment to Emley Company

Q100: Harter Company leased machinery to Stine Company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents