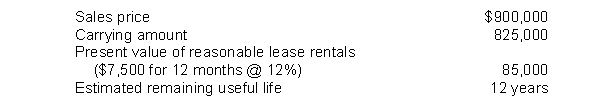

On December 31, 2015, Haden Corp. sold a machine to Ryan and simultaneously leased it back for one year. Pertinent information at this date follows:  In Haden's December 31, 2015 balance sheet, the deferred profit from the sale of this machine should be

In Haden's December 31, 2015 balance sheet, the deferred profit from the sale of this machine should be

A) $85,000.

B) $75,000.

C) $10,000.

D) $0.

Correct Answer:

Verified

Q104: Hayes Corp. is a manufacturer of truck

Q105: Jamar Co. sold its headquarters building at

Q106: Explain the procedures used by the lessee

Q107: On December 31, 2015, Burton, Inc. leased

Q108: Hughey Co. as lessee records a capital

Q110: Direct-financing lease (essay).Explain the procedures used to

Q111: Lucas, Inc. enters into a lease agreement

Q112: Use the following information for questions 104

Q113: A lessee had a ten-year capital lease

Q114: Use the following information for questions 104

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents