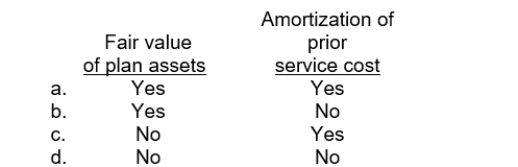

Which of the following items should be included in pension expense calculated by an employer who sponsors a defined-benefit pension plan for its employees?

Correct Answer:

Verified

Q18: The interest component of pension expense in

Q19: Companies compute the vested benefit obligation using

Q20: Companies report Accumulated Other Comprehensive Income (PSC)

Q21: Differing measures of the pension obligation can

Q22: In computing the service cost component of

Q24: In all pension plans, the accounting include

Q25: Alternative methods exist for the measurement of

Q26: Which of the following is not a

Q27: In a defined-benefit plan, the process of

Q28: One component of pension expense is actual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents