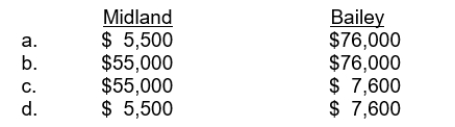

Midland Company follows U.S. GAAP for its external financial reporting whereas Bailey Company follows IFRS for its external financial reporting. The amount contributed by Midland for its defined contribution plan for 2015 amounted to $55,000 and the amount contributed by Bailey for its defined contribution plan for 2015 amounted to $76,000. The remaining service lives of employees at both firms is estimated to be 10 years. What is the amount of expense related to pension costs recognized by each company in its income statement for the year ended December 31, 2015?

Correct Answer:

Verified

Q127: Prior service cost is amortized into income

Q128: The International Accounting Standards Board has proposed

Q129: The accounting for defined-benefit pension plans is

Q130: The accounting staff of Elias Inc. has

Q131: Midland Company follows U.S. GAAP for its

Q133: Pension liabilities will be impacted in countries

Q134: Midland Company follows U.S. GAAP for its

Q135: Midland Company follows U.S. GAAP for its

Q136: Under IFRS companies may recognize actuarial gains

Q137: Which of the following is false regarding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents