Machinery was acquired at the beginning of the year. Depreciation recorded during the life of the machinery could result in

Correct Answer:

Verified

Q33: Which of the following will not result

Q34: Which of the following is not considered

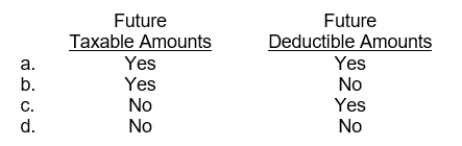

Q35: Which of the following temporary differences results

Q36: An example of a permanent difference is

A)

Q37: The deferred tax expense is the

A) increase

Q39: 22 Taxable income of a corporation differs

Q40: Assuming a 40% statutory tax rate applies

Q41: Deferred tax amounts that are related to

Q42: Major reasons for disclosure of deferred income

Q43: Use the following information for questions 58

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents