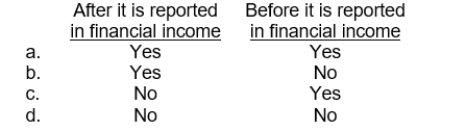

A temporary difference arises when a revenue item is reported for tax purposes in a period

Correct Answer:

Verified

Q20: Under the loss carryback approach, companies must

Q21: A company uses the equity method to

Q22: Taxable income of a corporation

A) differs from

Q23: A major distinction between temporary and permanent

Q24: 26. At the December 31, 2014

Q26: When a change in the tax rate

Q27: Stuart Corporation's taxable income differed from its

Q28: Which of the following are temporary differences

Q29: Which of the following is a temporary

Q30: Which of the following differences would result

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents