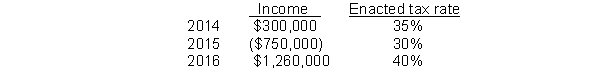

Use the following information for questions 93 and 94.

Operating income and tax rates for C.J. Company's first three years of operations were as

follows:

-Assuming that C.J. Company opts to carryback its 2015 NOL, what is the amount of income taxes payable at December 31, 2016?

A) $204,000

B) $504,000

C) $369,000

D) $324,000

Correct Answer:

Verified

Q95: Duncan Inc. uses the accrual method of

Q96: A reconciliation of Gentry Company's pretax accounting

Q97: Khan, Inc. reports a taxable and financial

Q98: On January 1, 2015, Gore, Inc. purchased

Q99: Munoz Corp.'s books showed pretax financial income

Q101: Wright Co., organized on January 2,

Q102: (a) Describe a deferred tax asset.(b) When

Q103: Under IFRS an affirmative judgment approach is

Q104: Under U.S. GAAP, the rate used to

Q105: For calendar year 2014, Kane Corp. reported

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents