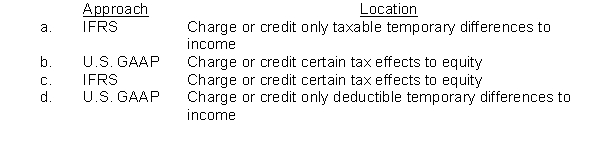

Match the approach, IFRS or U.S. GAAP, with the location where tax effects are reported:

Correct Answer:

Verified

Q117: In 2014, its first year of operations,

Q118: There are four types of temporary differences.

Q119: Computation of taxable income.The records for

Q120: Indicate and explain whether each of the

Q121: With regard to recognition of deferred tax

Q122: Alice, Inc. has the following deferred tax

Q123: Under IFRS, all tax effects are charged

Q124: Under IFRS, all potential liabilities associated with

Q125: Which of the following is false regarding

Q127: Jerome Co. has the following deferred tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents