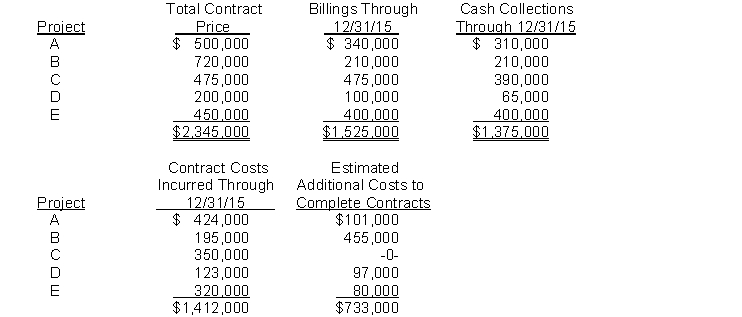

The board of directors of Ogle Construction Company is meeting to choose between the completed-contract method and the percentage-of-completion method of accounting for long-term contracts in the company's financial statements. You have been engaged to assist Ogle's controller in the preparation of a presentation to be given at the board meeting. The controller provides you with the following information:1. Ogle commenced doing business on January 1, 2015.2. Construction activities for the year ended December 31, 2015, were as follows:  3. Each contract is with a different customer."4. Any work remaining to be done on the contracts is expected to be completed in 2016.

3. Each contract is with a different customer."4. Any work remaining to be done on the contracts is expected to be completed in 2016.

Instructions

(a) Prepare a schedule by project, computing the amount of income (or loss) before selling, general, and administrative expenses for the year ended December 31, 2015, which would be reported under:(1) The completed-contract method.(2) The percentage-of-completion method (based on estimated costs).

(b) Prepare the general journal entry(ies) to record revenue and gross profit on project B (second project) for 2015, assuming that the percentage-of-completion method is used.

(c) Indicate the balances that would appear in the balance sheet at December 31, 2015 for the following accounts for Project D (fourth project), assuming that the percentage-of-completion method is used.Accounts ReceivableBillings on Construction in ProcessConstruction in Process(d) How would the balances in the accounts discussed in part (c) change (if at all) for Project D (fourth project), if the completed-contract method is used?"

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q120: In 2012, Concord Inc. sells inventory with

Q121: The International Accounting Standards Board (IASB) defines

Q122: IFRS requires immediate recognition of a loss

Q123: IFRS bases revenue recognition on the concepts

Q124: Houser Appliances accounts for all sales of

Q126: Evans Construction, Inc. experienced the following construction

Q127: IFRS prohibits use of the percentage-of-completion method

Q128: The revenue recognition principle provides that revenue

Q129: Penner Builders contracted to build a high-rise

Q130: Pasta Inn charges an initial fee of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents